Discover top dollar-cost averaging guides for 2025—learn how to invest consistently, reduce market timing risk and build long-term wealth with a smart strategy.

Table of Contents

ToggleIntroduction

Did you know that in 2025 the average investor is facing unprecedented volatility—with inflation jitters, rate shifts and global turbulence making timing the market harder than ever? That’s exactly why mastering smart strategies like dollar-cost averaging is vital. In this article you’ll discover updated, actionable dollar cost averaging guides, learn how to invest consistently and reduce market-timing risk, and understand why this approach matters now more than ever.

We’ll explore what dollar cost averaging is, why it works (and when it doesn’t), how to implement it step-by-step, and how to adapt it in the unique 2025 investment environment. If you’re serious about steady, disciplined investing over time, this is a must-read.

Introduction to Financial Education: Why Money Management Skills Matter in 2025 “Learn why financial education is essential in today’s fast-moving world. Discover the basics of saving, investing, and money management skills to achieve financial freedom and build wealth with Finomiles.”

What Is Dollar-Cost Averaging and Why It Matters in 2025

Imagine Maria, a 30-year-old investor who begins investing $300 every month in an equity index fund in January 2025—regardless of whether markets are up or down. She doesn’t wait for “the perfect moment”. Over the year she buys more units when prices dip, fewer when they spike. That’s the core of dollar-cost averaging (DCA).

What it is?

According to Investopedia, dollar-cost averaging involves investing a fixed amount at regular intervals, no matter the asset’s price.

The Investor.gov glossary defines it as investing equal portions at regular time intervals, regardless of market ups and downs.

The concept dates back to the work of Benjamin Graham, who described it in The Intelligent Investor.

Why it matters in 2025?

2025 is marked by heightened volatility: inflation concerns, global trade tensions, and rapid technology disruption. The Organisation for Economic Co‑operation and Development (OECD) warns that markets may remain disorderly.

Per a recent article, DCA “offers a disciplined, rule-based approach” for 2025’s dynamic environment.

For investors like Maria, DCA helps reduce the stress of guessing when to jump in and helps smooth out the cost basis when markets swing.

Key takeaway

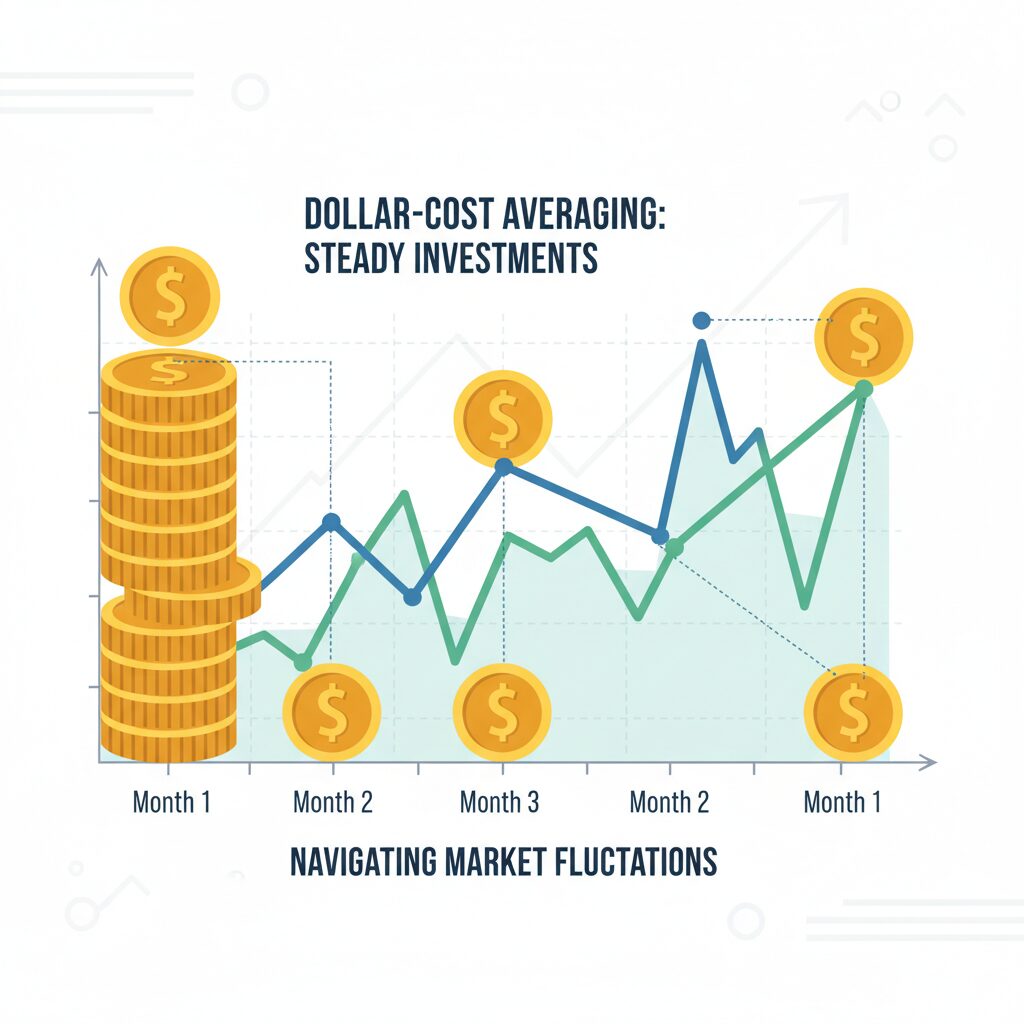

By deploying a review of dollar cost averaging guides and committing to regular investing, you significantly reduce your dependence on timing the market. Instead, you focus on time in the market.

According to Investopedia: What Is Dollar-Cost Averaging? — A complete technical definition and examples for DCA investors.

Historical Evidence & Real-World Case Studies

Let’s look at what the history books and real-life data say about this strategy.

Mini-story

Consider John, who began investing $1,000 monthly into an S&P 500 index fund in 2010 vs. Mark, who tried to wait for the “bottom” in late 2008. Over ten years, John stayed consistent and ended up with higher cumulative returns, whereas Mark lost time in the market waiting.

Evidence & case studies

A 2025 article analysed Indian SIP (Systematic Investment Plan) data and found investors who stuck with regular contributions since 2018 saw solid returns—even amid volatility.

Meanwhile, the Investopedia piece notes DCA may underperform lump-sum investing in steadily rising markets.

Research shows that while DCA helps manage risk and behavior, it doesn’t guarantee higher returns.

Actionable tips

Use historical data to benchmark: if you’d invested $X monthly over the last 5–10 years in a broad market fund, what would your average cost and unit count look like?

Use case studies (like Indian SIP growth) to reaffirm that consistency matters more than perfect timing.

Understand that DCA is a risk-management tool, not a “sure return” scheme.

Takeaway

Implementing dollar cost averaging guides means embracing the routine of investing. The routine is your edge—not predicting the next market move.

Fidelity: Guide to Dollar-Cost Averaging — A practical approach from one of the world’s largest investment platforms

Building Your Dollar-Cost Averaging Plan for 2025

Story first: Lina, age 25 in Newyork, sets up an automatic investment of $200 on the 1st of every month into a low-cost index mutual fund. She chooses this date to match her salary credit. She doesn’t worry about market news or daily quotes.

Step-by-step plan

1. Set your amount and frequency: e.g., monthly, or $200 quarterly.

2. Choose the asset: Ideally a diversified index fund or ETF (less risk than individual stocks).

3. Automate the process: Use auto-debit or direct debit. Eliminate decision fatigue.

4. Stick to the schedule: Regardless of market sentiment, invest. Yes—even in dips or spikes.

5. Review annually: Check if your budget or goals have changed, but avoid reacting to every headline.

Table: Sample Monthly DCA Plan

Month Amount Asset Price Units Bought

Jan $200 $15

Feb $200 ₹14

Mar $200 ₹15

… … … …

Useful considerations

Keep your investments within your budget—don’t commit money you need for the short term.

Avoid transaction costs eating your returns: If you invest very small amounts, fees may drag results.

Turn off emotional autopilot: Make the plan, set it, and let it run.

Takeaway

When you consult dollar cost averaging guides for 2025, the emphasis shifts to creating and maintaining the plan—not timing or speculating.

How Dollar-Cost Averaging Helps Reduce Market Timing Risk

Mini-story: Alex thought he’d wait for a “market bottom” before investing $12,000. But by the time he jumped in mid-year, markets had already recovered 8%. Meanwhile, Sara used DCA and invested $1,000 each month—she avoided the stress and captured more units when prices were down.

Why timing the market is so hard

Professional investors too struggle to “beat the market”.

Emotions like fear and greed drive bad decisions.

DCA neutralises the need to pick “when” and instead focuses on when-not to worry.

How DCA reduces risk

You buy more when prices are low and less when high—thus averaging your cost.

You avoid the panic of buying at peaks or selling after dips.

Behavioral bias is dampened: You’re not reacting to market noise.

Example benefits

In a declining market scenario, DCA led to higher wealth in hypothetical models.

In purely rising markets, DCA may slightly underperform lump sum—but in volatile 2025 conditions, DCA offers better emotional comfort and risk control.

Actionable tips

Accept that you may forgo a bit of upside in a hot market—but gain in peace of mind and risk management.

Don’t stop investing when markets dip—those are the times DCA shines.

Combine DCA with regular portfolio reviews, but avoid pausing contributions unless your financial situation changes significantly.

Takeaway

Using dollar cost averaging guides essentially means you’re insuring yourself against the folly of trying to pick perfect investment moments. It doesn’t eliminate risk—but it reduces one kind of risk: timing risk.

Learn more about The Psychology of Money: How Emotions Shape Financial Decisions? what is the main point of The Psychology of Money and how emotions affect finances. Learn key lessons to build smarter money habits today.

Tailoring Dollar-Cost Averaging for 2025’s Unique Market Landscape

Story: Robert, an investor in Europe, noted that after several years of good market growth, valuations were high, and central bank policy seemed uncertain in 2025. He still set up DCA but added two custom tweaks: he increased his monthly amount slightly after market dips and decreased it when volatility spiked (while still investing). He called it a “smart DCA hybrid”.

Why adapt DCA in 2025

Markets face structural headwinds: inflation, geopolitical risks, evolving regulation.

Many traditional dollar cost averaging guides were written in calmer times; 2025 requires more awareness.

Recent academic work (SmartDCA) suggests that adjusting contributions by price level may improve results.

Adaptive tweaks you can implement

Maintain a base DCA amount (e.g., $500/month).

After a correction of >10%, increase contributions temporarily (if your budget allows).

After a strong rally of >15 %, consider keeping the amount but resist increasing—avoid chasing momentum.

Re-evaluate asset allocation once per year to ensure diversification.

Use low-cost index funds/ETFs to reduce fees and enable fractional shares.

Actionable example

Base plan: $10,000/month into a broad global index fund.

Market falls 12% in one quarter: Increase to $12,000/month for next 3 months, then revert.

Strong rally of 20%: Stay at $10,000/month—do not escalate unless your income increases.

Takeaway

While standard dollar cost averaging guides are still relevant, 2025’s climate demands flexibility within the discipline. You keep the engine running, but you may tune the throttle slightly.

Data & Expert Insights on Dollar-Cost Averaging

There is no better way to appreciate the mechanics of dollar-cost averaging than looking at data and expert commentary.

Key statistics & insights

According to Investopedia’s May 2025 article, a $120,000 investment into the S&P 500 via DCA over 20 years reached $280,801; a lump-sum entry would have been ~$448,160.

A recent review by Bernstein notes that DCA reduces return variation (i.e., narrows the range of outcomes) though often at cost of slightly lower mean returns.

The Indian SIP data: in May 2025 SIP contributions reached record highs (Rs 266.88 billion), showing that regular investing continues to resonate even in volatile markets.

Expert quotes

> “If you’re a nervous investor, the key with dollar-cost averaging is kind of acknowledging that none of us know what is going to happen … The best thing you can do is stay invested.”

— David Blanchett, Portfolio Manager, PGIM, Feb 2025.

What this tells us

DCA is not about maximising return—it’s about reducing the risk of poor timing.

It works especially well when markets are erratic (such as 2025).

It still demands time horizon and patience: The benefits unfold over years, not months.

Actionable takeaways

Use data to set realistic expectations: prepare for moderate returns, not spectacular ones from DCA alone.

Accept that if the market only goes up steadily, DCA may lag—but you’ll still gain disciplined exposure.

Combine DCA with diversification, low fees, and regular review for best effect.

FAQs

Q1: What is the best frequency for dollar cost averaging in 2025?

You can choose monthly, bi-weekly or quarterly, but monthly is the most common and practical. The key is consistency—not timing. If you earn monthly, align your DCA schedule accordingly.

Q2: Can dollar-cost averaging guarantee I won’t lose money?

No, it cannot eliminate investment risk. If the asset you invest in declines for a long period, you still face losses. DCA reduces timing risk but not market risk.

Q3: Should I use dollar-cost averaging or invest a lump sum now?

Research indicates lump sum tends to outperform DCA about 2⁄3 of the time because you get more “time in the market”. However, if you feel uneasy about timing, DCA offers psychological and behavioural advantages.

Q4: Is dollar-cost averaging only for stocks?

No. You can use DCA for mutual funds, ETFs, bonds and even some cryptocurrencies—but make sure you understand the asset’s risk profile.

Q5: What mistakes should I avoid when using dollar-cost averaging?

Stopping your scheduled investments during market dips (that’s counter-productive).

Investing very small amounts where fees eat returns.

Choosing a highly concentrated or high-risk asset just because you’re regularly investing.

Ignoring your budget or investment horizon.

Q6: How long should I stay invested when following a DCA plan?

Typically, a minimum horizon of 5–10 years is advisable. The benefits of DCA accumulate over time; short-term horizons reduce its effectiveness.

Q7: Can I combine dollar-cost averaging with other strategies?

Yes. You can run DCA for your core portfolio and overlay tactical contributions or value-based additions when you identify opportunities (but only if you understand what you’re doing).

Conclusion

To sum up: In 2025’s unpredictable investment climate, adopting disciplined dollar-cost averaging is one of the most practical ways to build wealth without relying on perfect timing. You set the amount, pick the asset, automate your contributions, and stay committed. The strategy won’t guarantee you unbeatable returns—but it will give you something more valuable: control over your behaviour, reduced stress over “did I invest at the right time?”, and meaningful long-term exposure.

If you’re ready to begin:

Choose your regular amount and schedule it.

Select broad-market investments (index funds/ETFs) for diversification.

Automate and keep it simple.

Review annually—but don’t stop just because the headlines are scary.

Want to dive deeper? Check out our detailed guides on portfolio construction, risk management and behavioural finance. If you found this article helpful, subscribe for more expert-led investing strategies, share it with someone starting out, and implement your DCA plan today.

Let’s invest steadily — and confidently.