Discover how Fed Rate Decision impacts stocks, bonds, and investor sentiment. Learn strategies to navigate market volatility and protect your portfolio.

Table of Contents

ToggleIntroduction

When the Fed Rate Decision hits headlines, Wall Street holds its breath. A simple shift of 0.25% can send stocks soaring or tumbling, affecting millions of investors worldwide. The Federal Reserve, often called the Fed, controls the cost of borrowing money in the U.S. economy—and that ripples across global markets. Understanding how these decisions shape the stock market is not just for economists; it’s vital for everyday investors too.

1. Why the Fed Rate Decision Matters

The Fed Rate Decision influences the federal funds rate—the interest banks charge each other overnight. This seemingly technical move has wide-reaching effects:

Higher rates → borrowing becomes expensive, slowing corporate growth.

Lower rates → credit flows easily, boosting spending and investment.

Neutral stance → signals stability, calming investors.

For traders and long-term investors, watching Fed announcements is like reading the weather forecast before sailing. Investopedia notes that rate changes directly affect bond yields, consumer confidence, and corporate profits—all key drivers of stock performance.

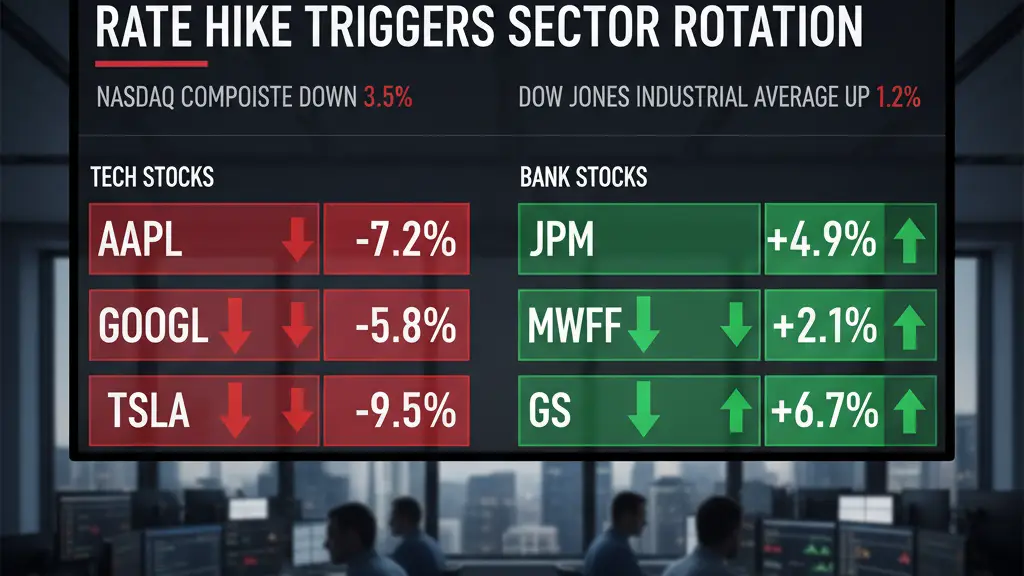

2. The Direct Impact on Stock Prices

When the Fed hikes rates, stocks often decline—especially in growth sectors like technology. Why? Because higher borrowing costs reduce profit margins.

For example:

Tech firms that rely on debt to fund innovation face tighter capital.

Banks may benefit since they earn more from loans.

Defensive sectors like healthcare and utilities often stay resilient.

A Fed Rate Decision doesn’t move all stocks equally; it redistributes momentum. Investors should rebalance portfolios accordingly.

3. Fed Rate Decision & Investor Sentiment

Markets are not just numbers—they’re emotions. The anticipation of a Fed Rate Decision often creates more volatility than the actual move. Traders speculate weeks in advance, creating a “buy the rumor, sell the news” effect.

Key sentiment drivers include:

Forward guidance – what the Fed says about future rates.

Inflation outlook: whether rising prices force aggressive hikes.

Economic signals: jobs data, consumer spending, GDP growth.

Case study: In March 2020, when the Fed slashed rates to near zero, investor confidence surged temporarily, even amid the COVID-19 crisis.

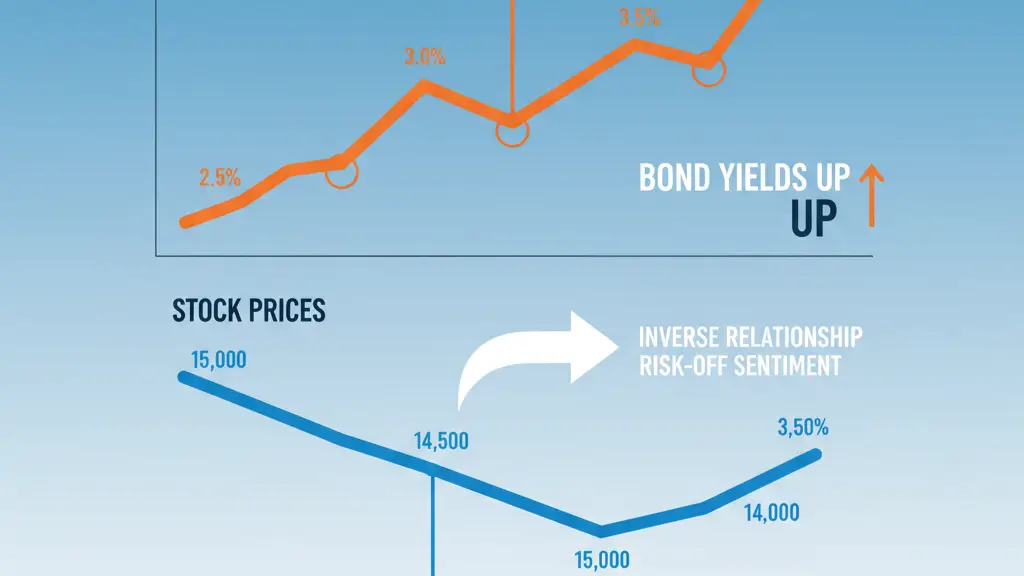

4. Bonds, Yields & the Stock Market

The bond market often predicts Fed policy before stocks react. When the Fed raises rates:

Bond yields: safer returns attract investors away from stocks.

Dividend stocks decline: they lose appeal compared to bonds.

Risk assets sell off: capital shifts toward fixed income.

Thus, monitoring Treasury yields is a smart way to anticipate stock market moves after a Fed Rate Decision.

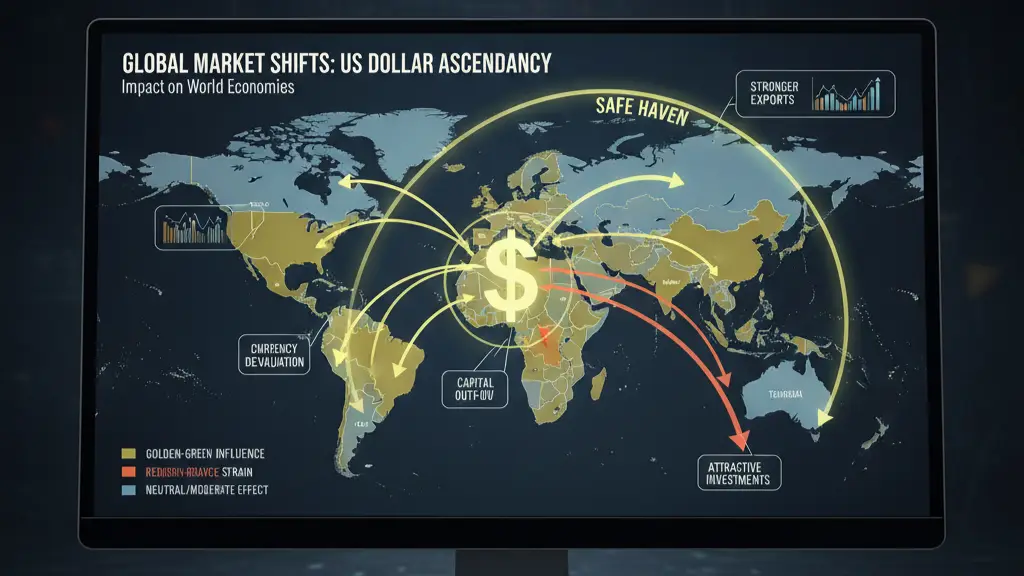

5. Global Effects of Fed Rate Decisions

The Fed doesn’t just move Wall Street—it shakes the world. Emerging markets, foreign currencies, and commodities like gold are deeply tied to U.S. rates.

Strong dollar: foreign stocks and exports suffer.

Weak dollar: commodities like oil and gold rise

Capital flows: global investors chase higher U.S. yields.

For instance, when the Fed hiked rates in 2018, developing nations like Turkey and Argentina saw sharp currency devaluations as capital fled to the U.S.

6. Strategies to Navigate Fed Rate Changes

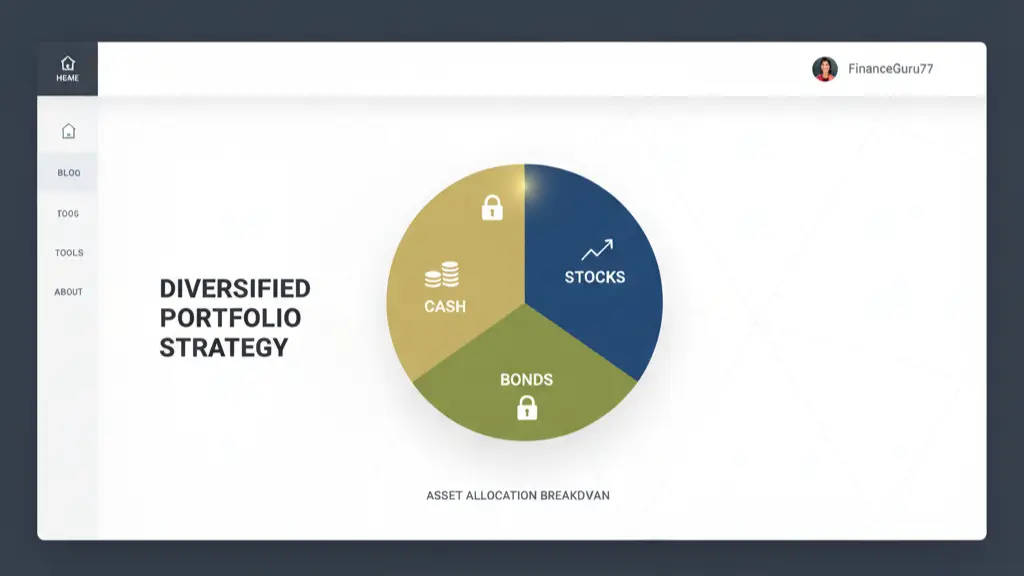

Smart investors don’t fear the Fed Rate Decision—they plan for it. Here are proven strategies:

Diversify holdings: spread across sectors.

Favor defensive stocks: utilities, healthcare, consumer staples.

Watch bond markets: they provide early warning signals

Hold cash reserves: for buying opportunities during volatility.

Internal resource: Check out our guide on Smart Money Management to build a resilient portfolio.

7. Expert Opinions on Rate Moves

Many financial experts emphasize that the Fed’s language matters as much as the rate itself. According to Forbes, the Fed’s forward guidance shapes long-term investor strategies more than a single hike or cut.

Notable insights:

Warren Buffett: Focus on business fundamentals, not rate noise.

Ray Dalio: Rates shift the balance between cash and risk assets.

Janet Yellen (former Fed Chair): Communication is key to stabilizing markets.

Learning from these insights helps investors prepare beyond just numbers.

8. FAQs

Q1. How does the Fed Rate Decision affect everyday investors?

It impacts loan rates, mortgages, credit cards, and stock portfolio performance.

Q2. Which sectors benefit from a Fed Rate Decision to raise rates?

Banks and financials often benefit, while tech and growth stocks may struggle.

Q3. How often does the Fed announce rate decisions?

Typically eight times a year during scheduled Federal Open Market Committee (FOMC) meetings.

Q4. Can the stock market rise after a Fed Rate Decision hike?

Yes, if investors believe the hike shows confidence in economic strength.

8. Conclusion: What It Means for You

The Fed Rate Decision is more than an economic event—it’s a compass for the stock market. It influences prices, investor psychology, and even global capital flows. Instead of reacting emotionally, investors should stay informed, diversified, and prepared.

Ready to build a stronger portfolio? Explore our Investment Strategies Guide and stay ahead of Fed-driven market shifts.